Call: 343-364-5789

Call: 343-364-5789

I provide businesses with a monthly bookkeeping service that would include such things as: managing both accounts payable and accounts receivable, recording sales, purchases and expenses, bank reconciliations, and administering payroll.

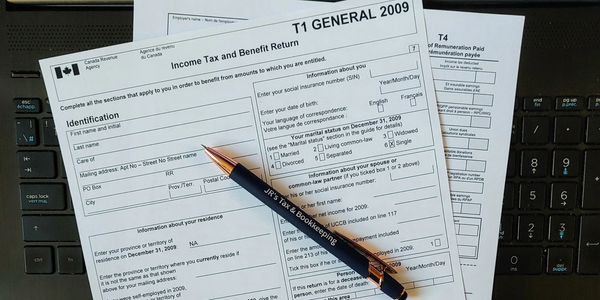

I assist my clients with the completion, filing and remitting of the various forms and documents that are required for compliance by the government, including T-Slip preparation, ROE's, GST, HST, Payroll, and WSIB.

I can prepare annual financial statements, cash flow management statements, and can assist with inventory management and forecasting.

Whether you are employed, self-employed, an independent contractor, have rental property, or own a corporation, I have the knowledge and am familiar with the different tax deductions and credits to ensure maximum benefits. I've been preparing tax returns in Kingston, ON, for over ten years.

Have a busy life? I understand that not everyone has the time to keep all records organized, I don't mind getting boxes of receipts handed to me.

Need to file taxes but hard to travel? I offer to come to my clients if it is more convenient for them. My laptop is equipped with a tax program, so I'm mobile. *** In-home and on-site visits may be restricted due to Covid-19. ***

I can assist with starting a small businesses and getting them set-up at a more competitive rate than my competitors. I assist with initial licensing, business plans, preparing articles of incorporation, setting up QuickBooks, and setting up program accounts such as HST and Payroll. I can also assist in getting a WSIB exemption, if applicable.

I can help ensure that your business is correctly structured as well as help you comply with monthly and annual financial reporting obligations such as Notices of Processing Review.

I offer full audit support in the case of a government audit.

Is your business growing? Are you making a lot of money? Incorporating your business may be very advantageous to you.

There are pros and cons to incorporating. Some of the common pros would be: reduced liability, lower tax rate, and protection of personal assets. Some common cons are: increased reporting obligations, and extra costs and fees associated to bookkeeping.

If you want to know more or need help incorporating, I'll be happy to assist.

I work virtually over the phone. Instead of booking a time to meet, we'll be booking some phone time. If documents need to be shared, you can transfer them to me by using my 'Secure Send' dropbox.